Brief by Shorts91 Newsdesk / 05:46pm on 01 Feb 2026,Sunday India

Finance Minister Nirmala Sitharaman presented Budget 2026 with a strong focus on infrastructure, manufacturing, defence and technology. The government expects economic growth of around 7% while keeping the fiscal deficit at 4.3%. Big announcements include new freight corridors, support for semiconductors, AI data centres and higher defence spending. Customs duty has been removed on 17 cancer drugs, making treatment cheaper. Tax compliance will be simpler under a new Income Tax Act from April 2026. Prime Minister Narendra Modi said the budget strengthens reforms and supports long-term growth, though markets reacted negatively due to higher trading taxes.

Brief by Shorts91 Newsdesk / 02:31pm on 01 Feb 2026,Sunday India

In the Union Budget 2026–27, Finance Minister Nirmala Sitharaman announced changes in customs duties and taxes affecting consumer prices across India. Several goods are set to become cheaper, including leather goods, footwear, microwave ovens, TV equipment, cameras, video‑game parts, foreign tour packages and cancer drugs, as import duties are reduced or exempted to lower costs and boost industry competitiveness. Conversely, some products will become costlier, such as coal, alcoholic liquor, and items like coffee and vending machines due to increased or reinstated duties. These adjustments aim to balance consumer relief and revenue generation. (PC: NDTV)

Brief by Shorts91 Newsdesk / 02:24pm on 01 Feb 2026,Sunday India

In the Union Budget 2026–27, the government allocated ₹95,692.31 crore to the Viksit Bharat‑Guarantee for Rozgar and Ajeevika Mission (Gramin) — a new rural employment programme replacing the long‑standing MGNREGA scheme. The mission, part of the broader Viksit Bharat 2047 vision, promises up to 125 days of work annually for rural households, strengthening livelihood and infrastructure in villages. Alongside, MGNREGA received ₹30,000 crore during the transition year. The combined focus on rural jobs reflects an effort to intensify employment support and uplift agrarian communities across India. (PC: The Hindu)

Brief by Shorts91 Newsdesk / 02:15pm on 01 Feb 2026,Sunday India

In early hours of 1 February 2026, unidentified attackers fired four to five shots outside Bollywood director Rohit Shetty’s Juhu residence in Mumbai; no injuries were reported. The notorious Lawrence Bishnoi gang claimed responsibility via social‑media posts by associates, naming individuals linked to the firing and issuing threats against Shetty and the film industry if warnings were ignored. Police have detained five suspects in Pune with alleged links to the gang, and authorities have launched a comprehensive investigation, deploying forensic teams and heightened security around the property. Motive remains under inquiry. (PC: PTI)

Brief by Shorts91 Newsdesk / 01:47pm on 01 Feb 2026,Sunday India

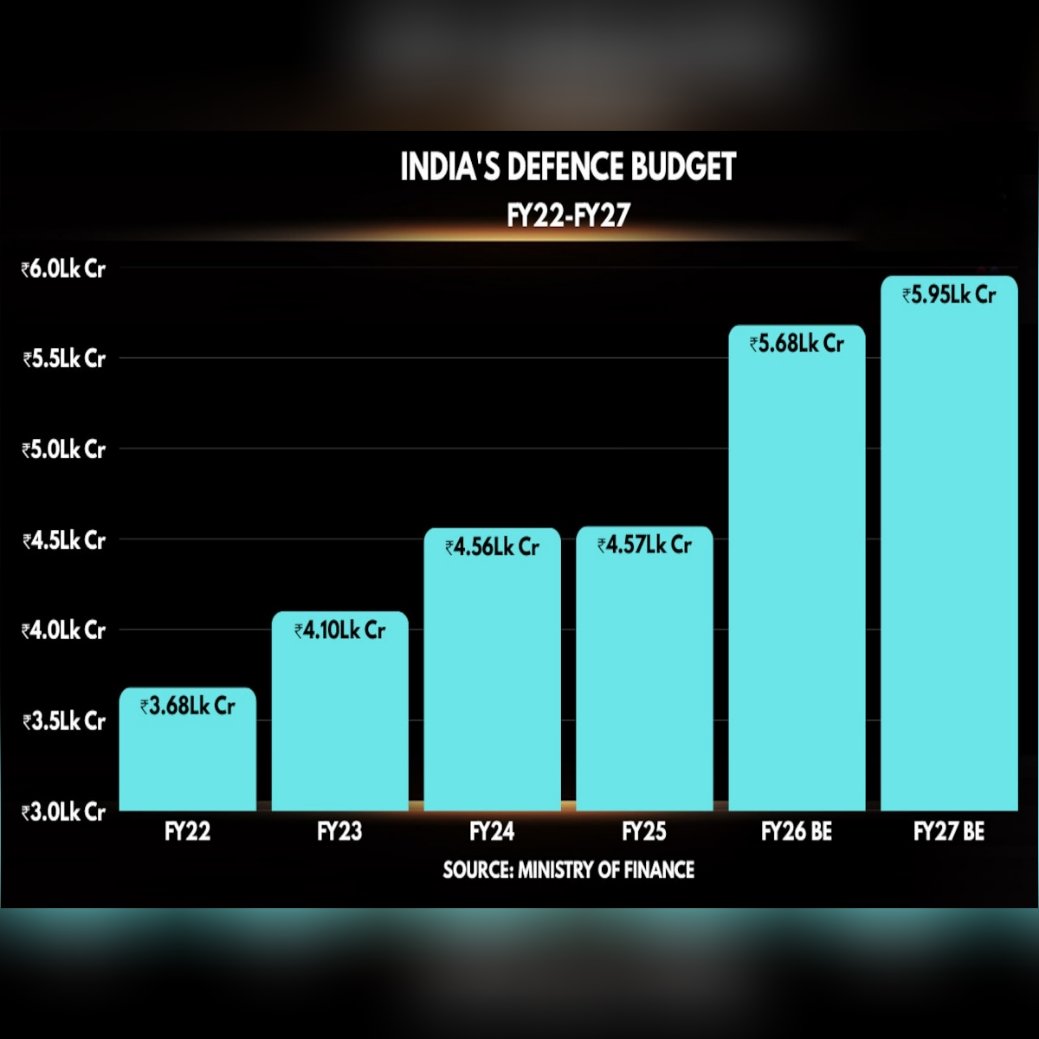

In the Union Budget 2026–27, Finance Minister Nirmala Sitharaman significantly increased India’s defence spending, boosting the total allocation to about ₹7.84–7.85 lakh crore, roughly 15% higher than last year’s budget. A capital outlay of ₹5.95 lakh crore — a 22% rise — was earmarked for modernisation, including aircraft, missiles, naval assets and drones to strengthen operational capabilities post Operation Sindoor. This surge also allocates substantial funds for pensions and revenue needs. The enhanced budget underscores New Delhi’s focus on military readiness, advanced technology acquisition and bolstering national security amid regional tensions.

Brief by Shorts91 Newsdesk / 01:39pm on 01 Feb 2026,Sunday India

In the Union Budget 2026–27, India made no allocation for the strategically important Chabahar port project in Iran, marking a significant shift from previous years when funds were regularly set aside for its development. The Chabahar port, located on the Gulf of Oman, has been a key element of India’s regional connectivity strategy, offering access to Afghanistan and Central Asia while bypassing Pakistan. Analysts link the absence of funding to escalating tensions between the United States and Iran and renewed U.S. sanctions, which have complicated India’s role in the project. The budget also reflects broader reorientation of foreign aid priorities. (PC: X)

Brief by Shorts91 Newsdesk / 01:07pm on 01 Feb 2026,Sunday India

In the Union Budget 2026–27, Finance Minister Nirmala Sitharaman mentioned 14 states, outlining major development projects tied to infrastructure, industry, tourism and connectivity. Poll-bound states like West Bengal, Tamil Nadu, Kerala and Assam received targeted initiatives including high-speed and freight rail corridors, eco-tourism trails, and cultural circuit schemes. Critical mineral rare earth corridors were announced for Odisha, Andhra Pradesh, Tamil Nadu and Kerala, aiming to boost domestic manufacturing. Northeastern states will benefit from a Buddhist Circuit tourism plan, while northern hill regions like Himachal Pradesh, Uttarakhand and J&K get mountain train and hiking projects, enhancing region-specific growth. (PC: The Hindu)

Brief by Shorts91 Newsdesk / 11:00am on 01 Feb 2026,Sunday India

Non-resident Indians can now invest directly in Indian shares through the Portfolio Investment Scheme, Finance Minister Nirmala Sitharaman said in the Union Budget 2026 speech. The scheme lets overseas investors buy and sell stocks using a special RBI-approved bank account. It also defines limits and compliance rules for each transaction. The individual investment cap for persons resident outside India has been raised from 5% to 10%, while the overall company limit goes up from 10% to 24%. Investments made under this route can be repatriated. The government will also review FEMA rules for non-debt instruments to simplify overseas investment flows. (PC: HT)

Brief by Shorts91 Newsdesk / 09:39am on 01 Feb 2026,Sunday India

Budget 2026 has proposed a lower Tax Collected at Source (TCS) rate for select overseas payments under the Liberalised Remittance Scheme. The TCS on foreign tour programme packages will be reduced to a flat 2 per cent from the earlier slab rates of 5 per cent and 20 per cent. The new rate will apply without any minimum amount condition. Remittances sent abroad for education and medical treatment will also attract a reduced TCS of 2 per cent instead of 5 per cent. The budget also clarified that manpower supply services will fall under the TDS contractor category, with tax deduction rates set at 1–2 per cent. (PC: Economic Times)

Brief by Shorts91 Newsdesk / 09:13am on 01 Feb 2026,Sunday India

Finance Minister Nirmala Sitharaman presented Union Budget 2026 with a focus on investment, manufacturing, and health support. Capital expenditure for FY27 was increased to Rs 12.2 lakh crore, and the fiscal deficit target was fixed at 4.3 per cent of GDP. No changes were announced in personal income tax slabs under the new Income Tax Act starting April 1. A tax holiday till 2047 was offered to foreign companies setting up cloud and data centre infrastructure in India. The government removed basic customs duty on 17 essential cancer drugs and expanded exemptions for rare disease treatments. Defence modernisation spending was raised, semiconductor funding was expanded, and seven high-speed rail corridors were cleared to improve connectivity and growth. (PC: X)