Brief by Shorts91 Newsdesk / 11:54am on 01 Feb 2026,Sunday International

Iran’s Supreme Leader Ayatollah Ali Khamenei warned that any US attack would lead to a “regional war” as Washington increases its military presence near Iran. State-linked media quoted him saying Iran would not be intimidated by US naval deployments. The warning comes as Iran prepares live-fire naval drills in the Strait of Hormuz, a key global oil route. US Central Command said its forces are operating in nearby waters and cautioned Iran against unsafe actions. US President Donald Trump said talks with Iran were under way and could produce an acceptable outcome. Iranian officials also confirmed progress on a negotiation framework.

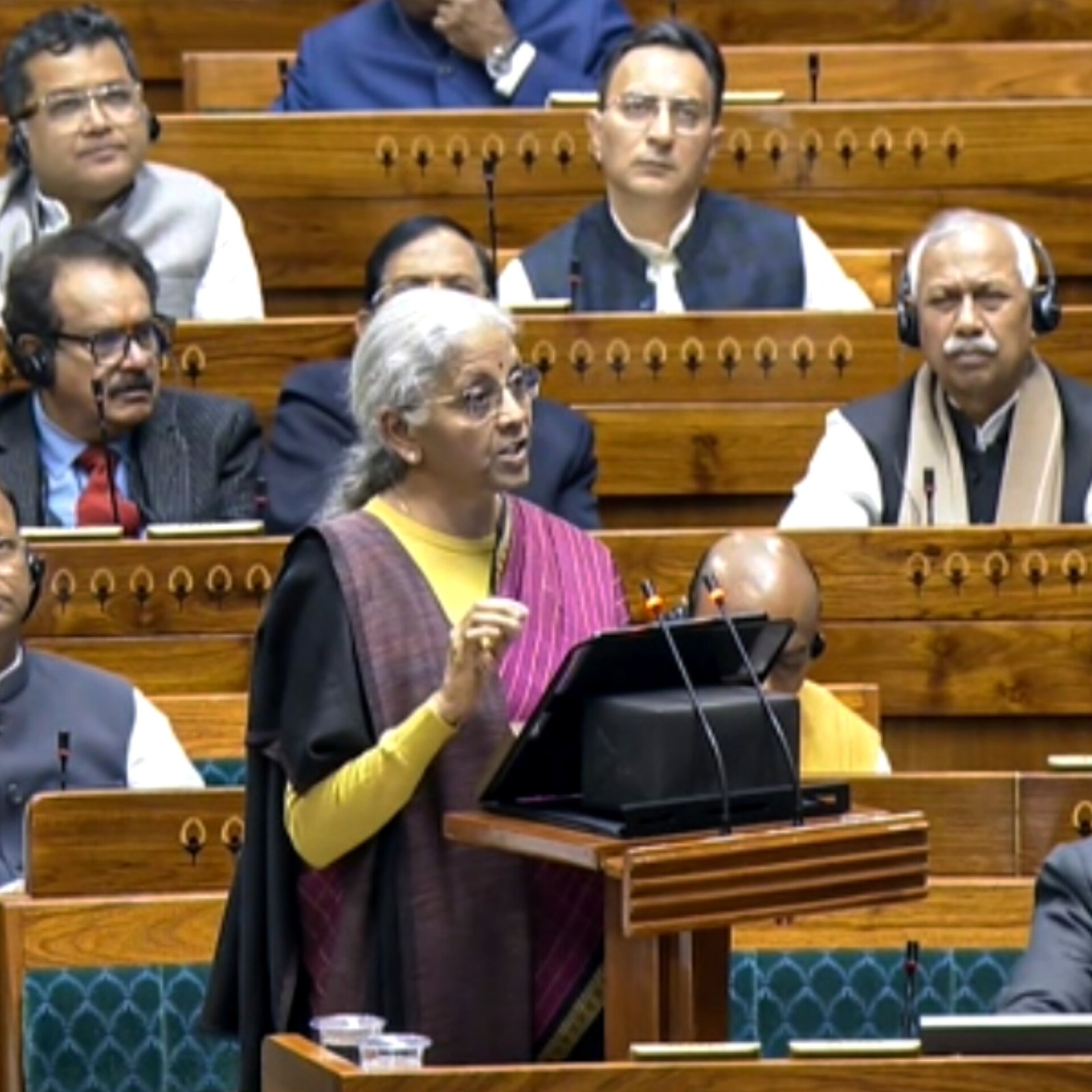

Brief by Shorts91 Newsdesk / 11:45am on 01 Feb 2026,Sunday Business

Indian stock markets closed sharply lower on Budget day after investors reacted to tax and investment signals. The Sensex fell 1,546.84 points to 80,722.94 and the Nifty50 dropped 495.20 points to 24,825.45. Losses widened after the Finance Minister’s speech. Market experts pointed to three clear reasons. First, the Budget proposed a higher securities transaction tax on futures and options trades. Second, there were no major new incentives for foreign portfolio investors. Third, foreign investors have continued to pull money out of Indian equities in recent months. PSU bank and metal stocks saw the heaviest selling during the session. (PC: India Today)

Brief by Shorts91 Newsdesk / 11:04am on 01 Feb 2026,Sunday India Global

Non-resident Indians can now invest directly in Indian shares through the Portfolio Investment Scheme, Finance Minister Nirmala Sitharaman said in the Union Budget 2026 speech. The scheme lets overseas investors buy and sell stocks using a special RBI-approved bank account. It also defines limits and compliance rules for each transaction. The individual investment cap for persons resident outside India has been raised from 5% to 10%, while the overall company limit goes up from 10% to 24%. Investments made under this route can be repatriated. The government will also review FEMA rules for non-debt instruments to simplify overseas investment flows. (PC: NDTV)

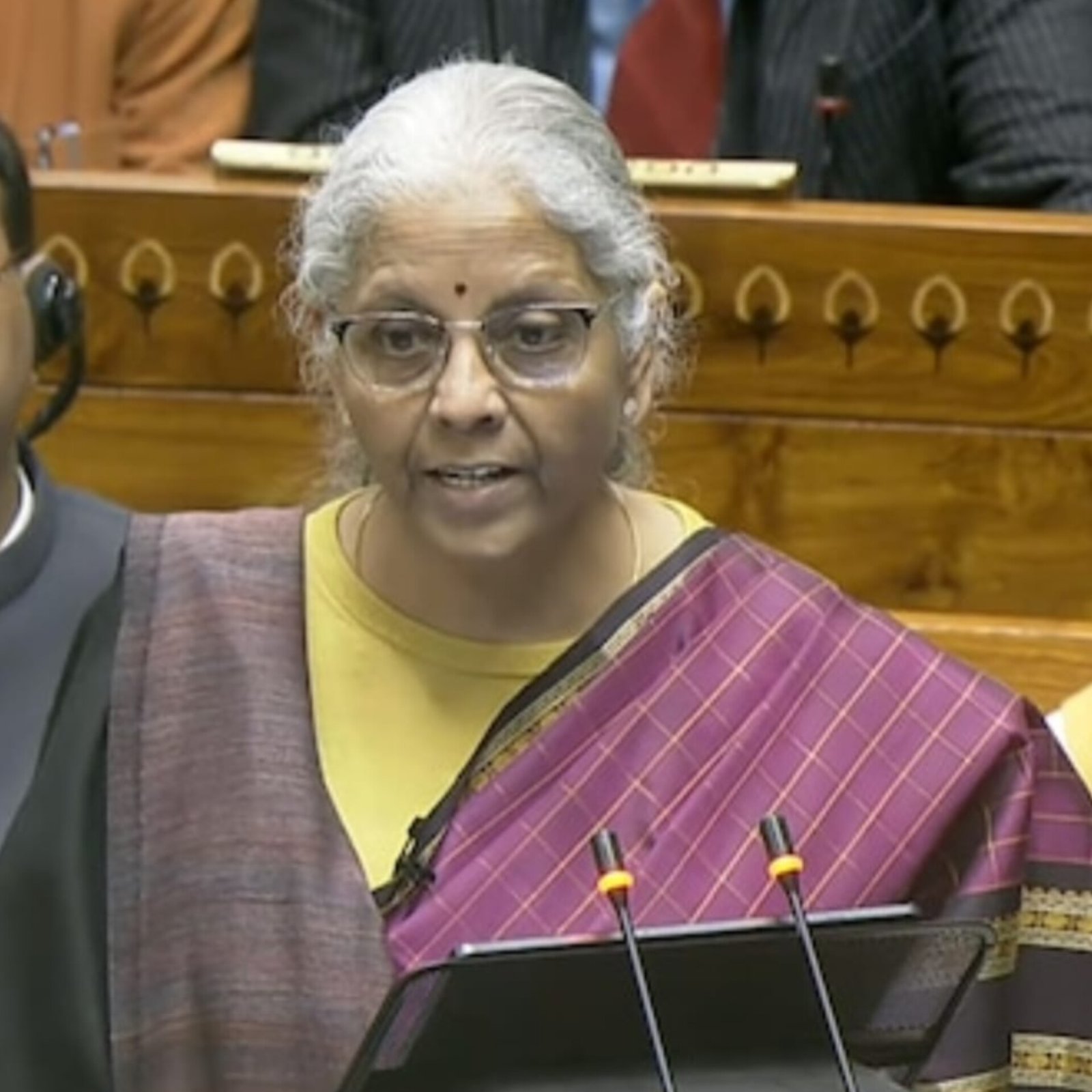

Brief by Shorts91 Newsdesk / 11:00am on 01 Feb 2026,Sunday India

Non-resident Indians can now invest directly in Indian shares through the Portfolio Investment Scheme, Finance Minister Nirmala Sitharaman said in the Union Budget 2026 speech. The scheme lets overseas investors buy and sell stocks using a special RBI-approved bank account. It also defines limits and compliance rules for each transaction. The individual investment cap for persons resident outside India has been raised from 5% to 10%, while the overall company limit goes up from 10% to 24%. Investments made under this route can be repatriated. The government will also review FEMA rules for non-debt instruments to simplify overseas investment flows. (PC: HT)

Brief by Shorts91 Newsdesk / 10:40am on 01 Feb 2026,Sunday India Global

Records released by the US Justice Department from Jeffrey Epstein’s seized devices show message exchanges with businessman Anil Ambani between 2017 and 2019, according to a report by The Wire. The messages refer to requests for help on US political access and discussions linked to Prime Minister Narendra Modi’s priorities. A May 2019 New York meeting is described in Epstein’s texts as involving a Modi “representative”. The report says Ambani attended a meeting at Epstein’s residence that day. It adds that the claim about a Modi representative is not independently confirmed. India’s external affairs ministry has earlier dismissed similar Epstein-linked references as unreliable. (PC: X)

Brief by Shorts91 Newsdesk / 10:25am on 01 Feb 2026,Sunday Defence

The government has raised the defence budget to Rs 7.85 lakh crore for FY26, up from Rs 6.81 lakh crore last year, marking an increase of about 15 per cent. The Budget speech did not include any defence policy announcements, but allocations show higher spending on military readiness and upgrades. Defence capital expenditure rose 28 per cent to Rs 2.31 lakh crore for new equipment and systems. The move supports ongoing modernisation and domestic manufacturing goals. The increase comes after recent security tensions in the region. Customs duty was also exempted on key imported raw materials used for defence maintenance, repair, and overhaul work. (PC: India Today)

Brief by Shorts91 Newsdesk / 10:20am on 01 Feb 2026,Sunday India Global

The Smithsonian’s National Museum of Asian Art will return three ancient bronze sculptures to India after research confirmed they were taken illegally from temples in Tamil Nadu in the 1950s. The idols include Shiva Nataraja, Somaskanda, and Saint Sundarar with Paravai from the Chola and Vijayanagar periods. Museum researchers traced old temple photographs from 1956 to 1959 with support from the French Institute of Pondicherry. The Archaeological Survey of India verified that the removals violated Indian law. One sculpture will later be displayed on long-term loan to explain its history and return. The museum said the decision follows a detailed provenance review. (PC: The Indian Express)

Brief by Shorts91 Newsdesk / 09:39am on 01 Feb 2026,Sunday India

Budget 2026 has proposed a lower Tax Collected at Source (TCS) rate for select overseas payments under the Liberalised Remittance Scheme. The TCS on foreign tour programme packages will be reduced to a flat 2 per cent from the earlier slab rates of 5 per cent and 20 per cent. The new rate will apply without any minimum amount condition. Remittances sent abroad for education and medical treatment will also attract a reduced TCS of 2 per cent instead of 5 per cent. The budget also clarified that manpower supply services will fall under the TDS contractor category, with tax deduction rates set at 1–2 per cent. (PC: Economic Times)

Brief by Shorts91 Newsdesk / 09:13am on 01 Feb 2026,Sunday India

Finance Minister Nirmala Sitharaman presented Union Budget 2026 with a focus on investment, manufacturing, and health support. Capital expenditure for FY27 was increased to Rs 12.2 lakh crore, and the fiscal deficit target was fixed at 4.3 per cent of GDP. No changes were announced in personal income tax slabs under the new Income Tax Act starting April 1. A tax holiday till 2047 was offered to foreign companies setting up cloud and data centre infrastructure in India. The government removed basic customs duty on 17 essential cancer drugs and expanded exemptions for rare disease treatments. Defence modernisation spending was raised, semiconductor funding was expanded, and seven high-speed rail corridors were cleared to improve connectivity and growth. (PC: X)

Brief by Shorts91 Newsdesk / 08:14am on 01 Feb 2026,Sunday India

Union Budget 2026–27 announced tax relief and compliance changes for people holding small foreign assets. The finance minister said no prosecution will apply for non-disclosure of non-immovable foreign assets with total value below ₹20 lakh. Such cases will face only a fine. This relief will apply from October 1, 2024. The government also launched a one-time six-month disclosure window for selected taxpayers, including students, to declare foreign assets or income. It covers undisclosed assets up to ₹1 crore and certain previously disclosed assets up to ₹5 crore. The Budget also introduced TDS on property sales by non-residents.